Partnership Deed Registration - Legalize Your Partnership

A Partnership Deed is a written legal document containing a Partnership agreement between the partners of a firm that summarises the terms and conditions of their partnership under the ‘Indian Partnership Act 1932’. Get help from the experts of Legal TaxAct for making PDR.

Get Quote Instantly

5 Years

Of Experience

1100 +

Cases Solved

5 +

Awards Gained

4 k +

Trusted Clients

2 k+

Queries Solved

What is a Partnership Deed?

A partnership deed is an agreement between the partners containing a Partnership agreement between the partners of the firm. The said deed includes the terms and conditions of the partnership like the nature of the business, a specific state in which the firm will operate its business activities, partnership firm structure or a clause related to the dissolution of the firm under the “Indian Partnership Act of 1932”.

Having a registered partnership deed is not at all mandatory, but it is advised to register the firm. The registration of a partnership is done before the Registrar of Firms. Registered Partnership Firm serves as an important reference point, resolving unpredicted conflicts between the partners and protecting their interests. A registered Firm is like having a contract with one friend before starting a business together, as it ensures a smooth and successful partnership.

A Partnership deed plays the role of a roadmap for operating a smooth business between two or more people who are partners in such a business. It outlines partners’ roles, rights and responsibilities.

This roadmap to a successful business operation of a Partnership firm includes the following:-

- Names and contributions of partners

- Profit and loss share ratio

- Duties and Decisions of each partner

- Adding or removing a partner

- Dissolution of Partnership

Pvt. Ltd. Company Registration

Get Pvt. Ltd. Registration

Get Quote Instantly

A private limited company is a company held privately by a group of persons. The member’s liability is limited to the shares held by them in the company. However, the shares of the private limited company cannot be publicly traded.

A private limited company is a popular form of business structure in India. It can be registered with just two members and two directors. However, the maximum number of members is 200. It is the most recommended form of business structure for millions of small and medium businesses that are professionally managed or family-owned.

Section 2(68) of the Companies Act, 2013 defines a private limited company as follows:

- A company having a minimum paid-up share capital.

- It restricts the right to transfer shares through its Articles of Association (AOA).

- It limits the number of its members to 200.

- It prohibits the issuance of a public invitation for subscribing to its securities.

Minimum Requirement of a Private Limited Company

- Minimum of two members.

- Members cannot be artificial legal entities.

- Minimum of two directors.

- A minimum of one director should be an Indian citizen residing in India.

- Minimum authorised share capital of Rs.1 lakhs.

- Digital Signature Certificate (DSC) of the directors.

How to apply

Section 8 Company Registration

Get Section 8 Registration

Get Quote Instantly

A Section 8 Company is a non-profit organisation that aims to promote sports, education, research, social welfare, art, science, and protection of the environment, etc. The concept of such companies is introduced under section 8 of the Companies Act, 2013.

The restriction on these companies is that these companies are permitted to use the profits only for the purpose for which the company was promoted. To register such a company or organisation, a minimum of two directors are required, and there is no requirement for a minimum paid-up capital to set up such a company in India.

Get your non-profit entity registered today with Section 8 Company Registration from Legal TaxAct! Our easy-to-use platform lets you quickly register and enjoy numerous tax benefits. Please use our reliable service and worry-free registration process to become a legally registered non-profit entity!

Registration Process

Our legal experts meticulously review all submitted documents to minimize the risk of errors or misleading information, ensuring a smooth and hassle-free process.

Our top legal professionals are here to assist you with all your documentation needs and licensing requirements.

Our lawyers will proceed with your documents to prepare a precise and legally sound draft.

Our lawyers will proceed with your documents to prepare a precise and legally sound draft.

Once your documents are successfully verified, our legal team will prepare the legal draft on your behalf. You can conveniently download it from our website.

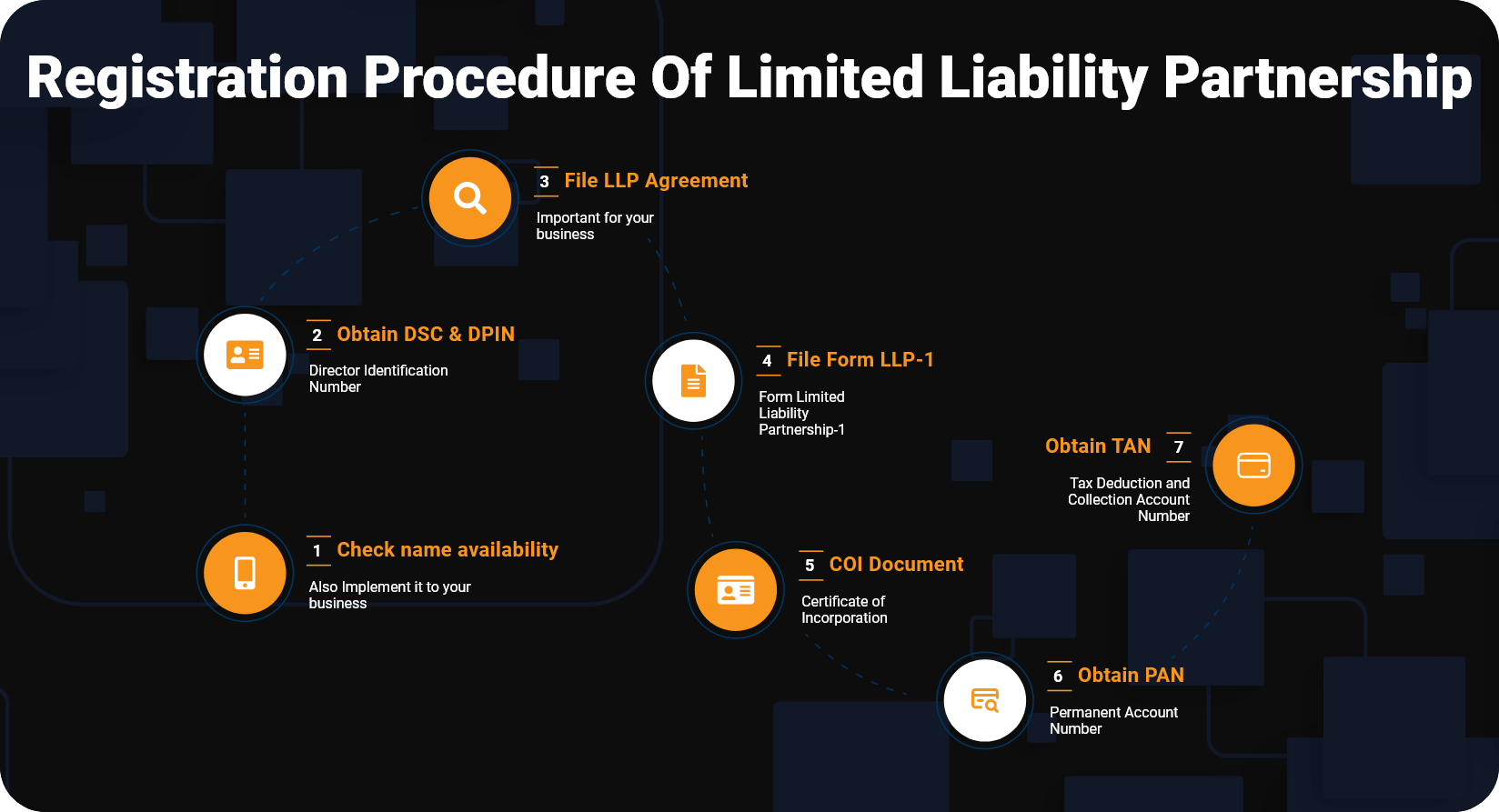

Limited Liability Partnership (LLP) Registration

Get LLP Registration

Get Quote Instantly

One of India’s preferred forms of business among entrepreneurs is Limited Liability Partnership (LLP). LLP is an alternative corporate business form that gives the benefits of both a Company and a Partnership Firm.

The LLP is a separate legal entity and is liable to the full extent of its assets. Still, the liability of the partners is limited to their agreed contribution to the LLP, and only a minimum of two partners are required to incorporate an LLP. For Limited Liability Partnership to be a legally valid entity, it must be registered under the Limited Liability Partnership Act, 2008.

So, are you ready to take your business to the next level? Legal TaxAct’s Limited Liability Partnership (LLP) Registration is the perfect way to do it! With our hassle-free process, get all the legal assistance you need to register your LLP in no time, enjoy the peace of mind that comes with Legal TaxAct’s professional service, and get ready for success!

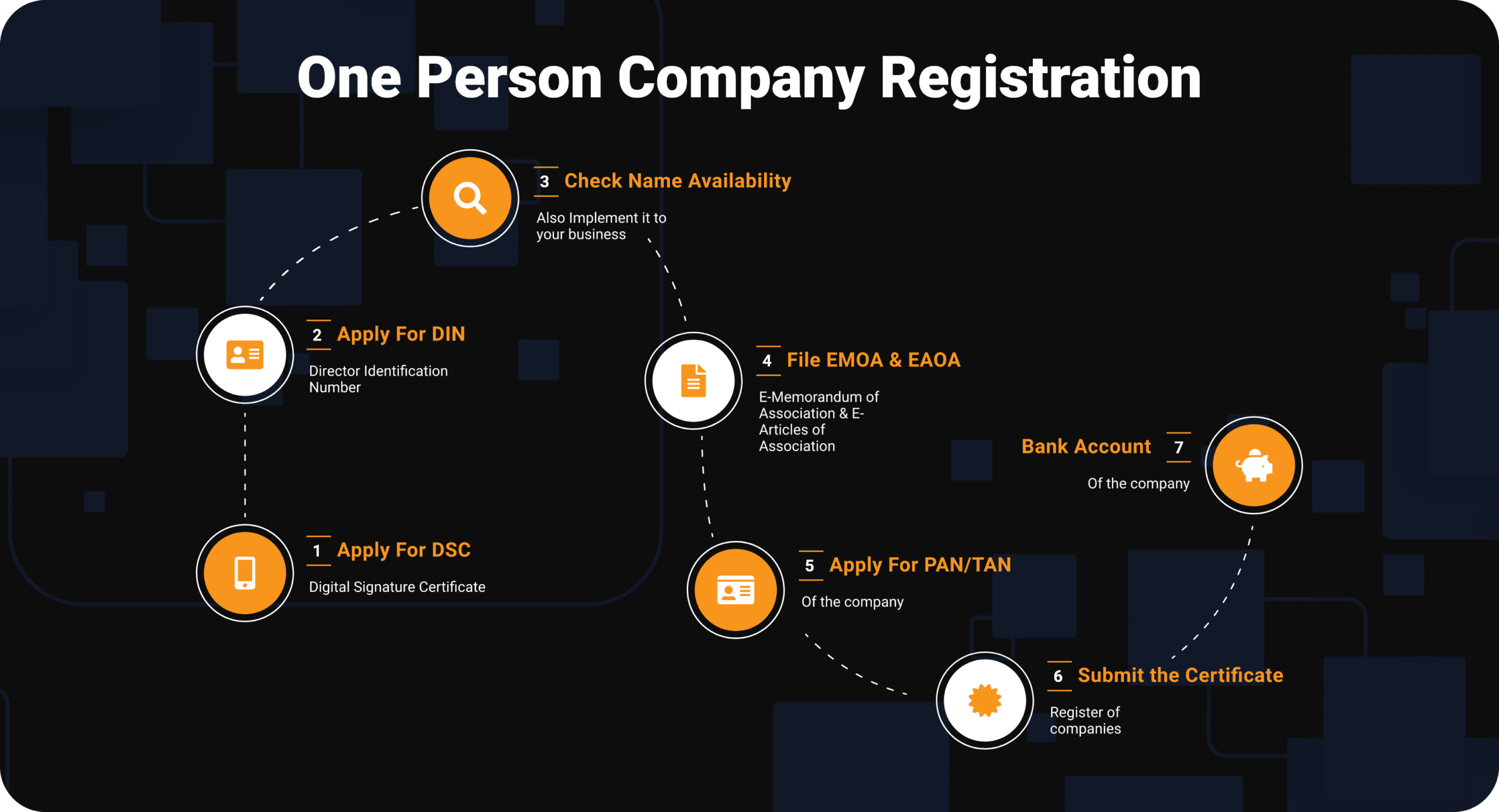

One Person Company (OPC) Registration

Get OPC Registration

Government fees & stamp duties extra. Please fill form to get detailed quote in seconds.

In 2 Weeks . Transparent Pricing . No Hidden Cost

Get Quote Instantly

5 Years

Of Experience

1100 +

Cases Solved

5 +

Awards Gained

4 k +

Trusted Clients

2 k+

Queries Solved

Are you ready to start a company but want to avoid creating it with others? Don’t worry! One Person Company (OPC) in India is a new concept introduced with the Companies Act 2013. As per section 2(62) of the Company’s Act 2013, a company can be formed with just one director and one member.

The director and member can be the same person. It is a form of a company where the compliance requirements are lesser than that of a private company. Thus, one individual who may be a resident or NRI can incorporate their business with a company’s features and the benefits of a sole proprietorship.

What are you waiting for? Register your Person Company from Legal TaxAct now! Our experienced team will handle everything for you, from paperwork to verifying documents, so you can enjoy knowing your business is in good hands. Start your company with Legal TaxAct and take that first step to success!

Benefits

Single Ownership and Management

OPC allows a single individual to form and manage a company. This is beneficial for entrepreneurs who want to start a business on their own without the need for additional shareholders or partners. The sole member has complete control over the company's operations and decision-making process.

Limited Liability

The biggest advantage of OPC registration is that it provides limited liability protection to the sole member. This means that the personal assets of the member are separate from the company's liabilities. In case of any financial losses or legal liabilities, the member's personal assets remain protected.

Separate Legal Entity

OPC is considered a separate legal entity from its owner. It has its own identity, distinct from the individual member. This provides credibility and enhances the business's image, making it easier to enter into contracts, raise funds, and establish business relationships.

Perpetual Succession

OPC registration ensures perpetual succession, which means the company continues to exist even if the owner or promoter passes away or becomes incapacitated. The shares of the company can be transferred to a nominee mentioned in the incorporation documents, ensuring the continuity of the business.

Easy Funding and Bank Loans

OPCs have better access to funding and bank loans compared to sole proprietorships or partnerships. Financial institutions and investors find OPCs more trustworthy and are more willing to provide financial assistance. OPCs can raise funds through equity or debt and have the option to issue shares to investors.

Tax Advantages

OPCs enjoy certain tax benefits. They are eligible for tax deductions, exemptions, and benefits available to other types of companies. OPCs are taxed at the corporate tax rate, which may be lower than individual tax rates, resulting in potential tax savings.

FAQS

Q1. What essential elements to keep in mind while legal Drafting?

While working on a legal draft, one must keep the following things in mind:

- Avoid ambiguity

- Be Clear

- Keep it simple

- Be precise

- Unilateralism

- Remember and follow the chronology

- Don’t forget to define important things

- Focus on adaptability

- The draft should be in a lucid way

- Be logical

Q2. How many types of drafts are there in the process of Legal Drafting?

There are mainly three types of drafts in the legal drafting process, these are:

- The first draft focuses on the proper mentioning of facts

- The second draft works on the correction of the first draft’s language to make it easy to understand

- The final draft is to give it the final touch so that it can convince the concerned authority

Q3. Are ‘Community Jargons’ allowed in Legal Drafting?

No, community Jargon is not allowed in Legal Drafting.

Q4. Should I hire a lawyer to prepare my legal draft?

If you are well aware of the legalities and have proper knowledge of the subject matter, you can try it out yourself. However, while preparing a legal draft, there are many parameters and conditions one must keep in mind which may affect you in future, so it is best to take help from professionals to avoid legal actions or conflicts.

Q5. What is a draft?

A draft is a precise legal document that gives all the details about a (legal) case. It is a rough document prepared by the lawyer, which later requires a final touch to compose the original draft.